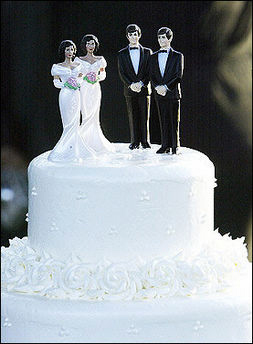

Same-sex marriage in Florida is not recognized, which has posed a number of questions to Jacksonville and other Florida divorce attorneys about how to handle to such matters. The State of Florida originally initiated a statute defining that same-sex marriage would not be considered legally authorized or recognized in the state of Florida. That, not being enough, in 2008, Floridians voted by 62% to institute Amendment 2 to the Constitution, which gave us the language of Article I, Section 2, defining marriage as, “the legal union of only one man and one woman as husband and wife, no other legal union that is treated as marriage or the substantial equivalent thereof shall be valid or recognized.”

As other states, like Vermont, have enacted the right for same-sex couples to forge in the bonds of matrimony, that marriage is not given full faith and credit in states like Florida. In accordance with Florida Statute 741.212, such marriages that are valid elsewhere are not considered valid if the couple decides to reside in Florida. Therefore, a legal marriage is not legally dissolved in Florida. This means that if the marriage is valid in another state and not recognized where the couple resides, for the marriage to be properly dissolved, the couple must move to a state where their marriage is legal. In places like Vermont, the residency requirement before filing for divorce is one year as opposed to six months in Florida. This can put a strain on the individuals if they were to have the marriage dissolved effectively. However, there may be arguments to say that since you reside in a State where the marriage is not recognized that there are no real reasons to have it properly dissolved because in essence, the marriage is void. In that situation though, the problem would be in dividing property, assets and debts, which can be divided equally or fairly in a divorce.

This leaves a great deal of difficulty for same-sex couples and could potentially be construed as unconstitutional and interfering with ones right to travel, which has been upheld as a constitutional right by the U.S. Supreme Court, beginning with U.S. v Guest, 383 U.S. 745 (1966).

Jacksonville Divorce Lawyer Blog

Jacksonville Divorce Lawyer Blog

Gambling debts, martial affairs, excessive drug use and the like can lead to a divorce in Florida. However, Florida is a no-fault state so these things do not really come into play when determining such things as alimony. As a Jacksonville divorce

Gambling debts, martial affairs, excessive drug use and the like can lead to a divorce in Florida. However, Florida is a no-fault state so these things do not really come into play when determining such things as alimony. As a Jacksonville divorce  In a divorce or paternity case involving issues with children including time-sharing/visitation, parental responsibility or child support, the court may refer the parties to mediation. Florida law provides for the judge in such a proceeding to send the parties to mediation over disputed matters to determine if such things can be settled out of court, Florida Statute

In a divorce or paternity case involving issues with children including time-sharing/visitation, parental responsibility or child support, the court may refer the parties to mediation. Florida law provides for the judge in such a proceeding to send the parties to mediation over disputed matters to determine if such things can be settled out of court, Florida Statute  In a divorce, often one party may have more financial security than the other party, either by income, inheritance, or the like, thus putting the other party in a financial situation that makes it difficult to pay attorney’s fees. When hiring a lawyer for a divorce or modification action in Florida, the concern is the price for an attorney and whether she or he will have the ability to pay for an attorney. The other concern is that, knowing the financial situation, the other party will have the money available to pay for an attorney and that will require the party without disposable income to borrow money from family or represent himself or herself. As a Jacksonville

In a divorce, often one party may have more financial security than the other party, either by income, inheritance, or the like, thus putting the other party in a financial situation that makes it difficult to pay attorney’s fees. When hiring a lawyer for a divorce or modification action in Florida, the concern is the price for an attorney and whether she or he will have the ability to pay for an attorney. The other concern is that, knowing the financial situation, the other party will have the money available to pay for an attorney and that will require the party without disposable income to borrow money from family or represent himself or herself. As a Jacksonville  Florida recognizes the use of premarital and post marital agreements when deciding the outcome or possible outcome of a divorce. In some cases, during the marriage the parties may find themselves thinking of divorcing and may enter into a marital settlement agreement, but ultimately not have the agreement entered with the court because they are able to reconcile the marriage, this too is valid in Florida. When parties decide to divorce any agreement between the parties, whether premarital agreement, post marital agreement or a prior marital settlement agreement that allows for enforcement later if the parties reconcile, can be construed as an enforceable contract in the divorce proceedings. As a Jacksonville divorce lawyer, issues can arise regarding the enforceability of the agreement and in order to fight the document, the parties may need to hire separate attorneys, potentially leaving one of the parties needing financial assistance during the contest of the divorce. Therefore,

Florida recognizes the use of premarital and post marital agreements when deciding the outcome or possible outcome of a divorce. In some cases, during the marriage the parties may find themselves thinking of divorcing and may enter into a marital settlement agreement, but ultimately not have the agreement entered with the court because they are able to reconcile the marriage, this too is valid in Florida. When parties decide to divorce any agreement between the parties, whether premarital agreement, post marital agreement or a prior marital settlement agreement that allows for enforcement later if the parties reconcile, can be construed as an enforceable contract in the divorce proceedings. As a Jacksonville divorce lawyer, issues can arise regarding the enforceability of the agreement and in order to fight the document, the parties may need to hire separate attorneys, potentially leaving one of the parties needing financial assistance during the contest of the divorce. Therefore,  In some circuits in Florida, like Jacksonville, St. Augustine and other surrounding areas, cases involving divorce, paternity, child support or other

In some circuits in Florida, like Jacksonville, St. Augustine and other surrounding areas, cases involving divorce, paternity, child support or other  Florida divorces involving alimony issues have given rise to new legislation over the last few years and will continue into the near future. The alimony debate in Florida is based on a number of factors, including the lack of an alimony calculation that is state mandated in determining the amount of alimony to be paid. According to a press release on Market Watch, Anderson Cooper is reportedly doing a show on Monday, January 9, 2012 highlighting the issues of Florida alimony; however, the report that came out about the show seems to have things reported incorrectly and in an effort to decrease emotional responses, I thought, as a Florida

Florida divorces involving alimony issues have given rise to new legislation over the last few years and will continue into the near future. The alimony debate in Florida is based on a number of factors, including the lack of an alimony calculation that is state mandated in determining the amount of alimony to be paid. According to a press release on Market Watch, Anderson Cooper is reportedly doing a show on Monday, January 9, 2012 highlighting the issues of Florida alimony; however, the report that came out about the show seems to have things reported incorrectly and in an effort to decrease emotional responses, I thought, as a Florida  Retirement benefits are often a combination of employee and employer contributions during ones job. The retirement benefits are normally grown through the length of employment, and if an employee is married during his/her employment, then the contribution he/she is making is actually a marital contribution for purposes of a Florida divorce. As a

Retirement benefits are often a combination of employee and employer contributions during ones job. The retirement benefits are normally grown through the length of employment, and if an employee is married during his/her employment, then the contribution he/she is making is actually a marital contribution for purposes of a Florida divorce. As a  When going through a divorce in Florida, it is often difficult to think about separating the things that have been accumulated during the marriage. As a Jacksonville

When going through a divorce in Florida, it is often difficult to think about separating the things that have been accumulated during the marriage. As a Jacksonville In a Florida

In a Florida